Single paycheck tax calculator

This number is the gross pay per pay period. Overview of Indiana Taxes Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status.

Calculation Of Federal Employment Taxes Payroll Services

Single Married Filing Separately.

. Elective Deferrals401k etc Payroll Taxes. Switch to Idaho hourly calculator. It can also be used to help fill steps 3 and 4 of a W-4 form.

Figure out your filing status. The PaycheckCity salary calculator will do the calculating for you. Calculating your Oregon state income tax is similar to the steps we listed on our Federal paycheck calculator.

Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. Plus you will find instructions on how to increase or decrease that tax withholding amount. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Ohio Taxable Income Rate. Your employer will withhold money from your paycheck for that tax as well.

Pre-Tax Deductions Pre-tax Deduction Rate Annual Max Prior YTD CP. When done create the W-4 and the. Calculate your Idaho net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Idaho paycheck calculator.

SmartAssets Ohio paycheck calculator shows your hourly and salary income after federal state and local taxes. Work out your adjusted gross. Subtract any deductions and payroll taxes from the gross pay to get net pay.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Some states follow the federal tax year some states start on July 01 and end on Jun 30. Use the PAYucator or W-4 Check tool below and at the end of the paycheck calculator in section P163 you will see your per paycheck tax withholding amount.

Dont want to calculate this by hand. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Total Non-Tax Deductions.

Similar to the tax year federal income tax rates are different from each state. Calculate your take home pay after federal Oregon taxes deductions and exemptions. The state tax year is also 12 months but it differs from state to state.

Federal taxes are progressive. Updated for 2022 tax year.

How To Calculate Payroll Taxes Methods Examples More

2 My Paycheck My Future Self Portfolio

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate Federal Withholding Tax Youtube

Paycheck Calculator Take Home Pay Calculator

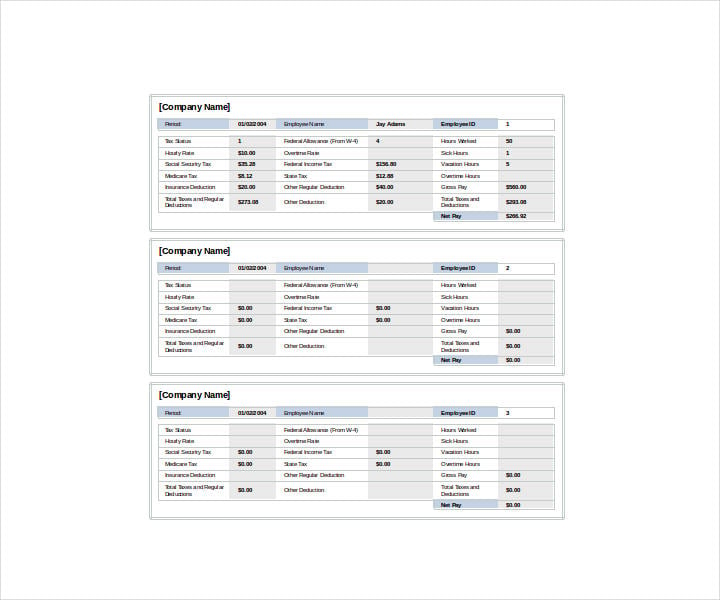

Paycheck Calculator Template Download Printable Pdf Templateroller

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Federal Income Tax

How To Calculate 2019 Federal Income Withhold Manually

11 Paycheck Stub Templates In Excel Free Premium Templates

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Take Home Pay Calculator

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Payroll Tax Calculator For Employers Gusto

Enerpize The Ultimate Cheat Sheet On Payroll

Advanced Paycheck Tax Calculator By Ryan Soothsawyer